Understanding FAFSA Simplification

Frequently Asked Questions

Frequently Asked Questions- Contributors

Contributor is a new term introduced on the 2024-25 FAFSA form. It refers to anyone asked to provide information on a student's FAFSA form:

- the studen

- the student's spouse

- a biological or adopted parent

- the parent's spouse (stepparent).

A Contributor on the FAFSA form doesn't mean they are financially responsible for the student's education costs.

The student's or parent's answers on the FAFSA will determine which Contributors (if any) will be required to provide information.

A Contributor will be invited to complete their portion of the FAFSA form by entering their name, date of birth, Social Security number, and email address.

A Contributor must provide personal and financial information in their own sections of the FAFSA form. Unlike previous versions of the FAFSA, no one other than the Contributor will be able to enter the Contributor's information.

Following are the steps that each Contributor must follow to enter information on the FAFSA:

- Contributor receives an email informing them that they've been identified as a contributor.

- Contributor creates a StudentAid.gov account if they don't already have one.

- Contributor logs in to account using their FSA ID account username and password.

- Contributor reviews information about completing their section of the FAFSA form.

- Contributor provides the required information on the student's FAFSA form.

Being a contributor does NOT implicate financial responsibility. However, if a required contributor refuses to provide their information, it will result in an incomplete FAFSA form, and the student will become ineligible for federal, state, and CSU student aid.

Students that live with a single/divorced/widowed parent and receive most support from that parent, will report only one parent on the FAFSA.

The parent included in the FAFSA as a contributor must be the parent that provides the greater portion of the student's financial support. If that primary parent is remarried, the income of that parent's spouse (stepparent) will also be required.

According to the Future Act, all students and contributors must provide consent to the following:

- Have their federal tax information transferred directly into the FAFSA® form via direct data exchange with the IRS;

- Have their federal tax information used to determine the student's eligibility for federal student aid; and

- Allow the U.S. Department of Education to share its federal tax information with postsecondary institutions and state higher education agencies for use in awarding and administering financial aid.

Important: Even if students or contributors don't have a Social Security number, didn't file taxes, or filed taxes outside of the U.S., they still need to provide consent.

- If a student or required contributor doesn't provide consent to have their federal tax information transferred into the FAFSA® form, the student will not be eligible for federal student aid, CA state aid, or CSU aid—even if they manually enter tax information into the FAFSA form. There is no exception to providing consent.

- Information about how federal tax information will be used and the consequences of not providing consent will be included on the FAFSA form.

- Legal parents must provide consent to transfer federal tax information, even if one of the parents didn't file or had no income. If parents fail to provide consent, the student won't be eligible to receive federal student aid, CA state aid, or CSU aid.

Frequently Asked Questions - FSA ID

The FSA ID is a username and password combination you use to log in to U.S. Department of Education (ED) online systems. The FSA ID is your legal signature and shouldn't be created or used by anyone other than you—not even your parent, your child, a school official, or a loan company representative.

- All students and contributors must create a StudentAid.gov account to complete the FAFSA form online.

- Students and contributors will use their FSA ID account username and password to log in to their accounts.

- Even if a parent or spouse contributor doesn't have a Social Security number, they can still get an FSA ID using their ITIN to fill out their portion of the student's FAFSA form online.

No. The FSA ID process is not changing. It's even better that parents and students can create the FSA ID and have it ready anytime before the FAFSA application starts.

To create an FSA ID, you'll need your Social Security number (SSN). Other information required is full name and date of birth. You'll also need to create a memorable username and password and complete challenge questions and answers to retrieve your account information if you forget it. You'll be required to provide your email address or mobile phone number when you make your FSA ID. Providing a mobile phone number and/or email address that you have access to will make it easier to log in to ED online systems and allow you to verify your FSA ID before using it on the FAFSA and additional account recovery options.

This Federal Student Aid video can help create a step-by-step FSA ID.

Yes. Starting 2024-25, parents and/or spouses who are not U.S. Citizens or Eligible Noncitizens can use their Individual Taxpayer Identification Number (ITIN) to create an FSA ID once their taxes are still required.

Your parents' citizenship status doesn't affect your eligibility for federal aid. They cannot create an FSA ID, but you can complete the FAFSA on paper and ask for their signatures. For FAFSA purposes, you must provide your parents' income, no matter where they reside.

If the parent you indicate on the FAFSA is the parent who remarried, it'll depend on how they filed taxes. If they filed jointly, only one parent needs an FSA ID. If they filed separately, both parents will need their own FSA ID.

No. You can retrieve your existing FSA ID if you forgot your username and password.

We have seen different situations when a parent creates their FSA ID, verifies it, and is ready to use, and sometimes the system asks them to wait 24-48 hours to use it. It depends on the information matching system.

We recommend creating it a few days before starting the form. FSA IDs made on the day of might work but will not have full functionality yet, like using the Direct Data Exchange (FADDX) to transfer tax information.

Two-step verification, a form of multi-factor authentication (MFA), helps protect your StudentAid.gov account with additional protection from fraud.

Yes! Each contributor must have their own, unique phone number or email.

- A student and parent cannot use the same phone number email for Multi-factor Authentication (MFA).

- A student and their spouse cannot use the same phone number or email for MFA.

- Two parents cannot use the same phone number or email for MFA.

This depends on the family's situation. For example, if a student has married parents who filed taxes separately, both parents will need to make an FSA ID.

None. Just ensure they are verified and ready to use when the FAFSA 2024-25 opens sometime in December 2023.

Starting with the 2024-25 FAFSA, a separate signature page will no longer exist. There are two alternative options for contributors to provide consent who do not want to or refuse to create an FSA ID:

- The first example would be the student applying using the paper FAFSA and obtaining wet signatures from all contributors, including the parents, who also affirm their consent.

- The other option is for the student completes their section and self-reports information for the parent section on the FAFSA form. When the student submits their FAFSA form without the parent's signature, it will be placed in rejected status by the FAFSA Processing System (FPS). The parent can then provide their signature and consent on a paper copy of the FAFSA Submission Summary. This method is not recommended due to complexity and increased processing time.

Frequently Asked Questions - Consent, Taxes, and Financial Data

The Future Act (PDF) requires that every contributor on the FAFSA provide consent to share their taxes information in the application so that the IRS can share this information with Federal Student Aid (FSA). All parties whose Federal Tax Information (FTI) is included on a student's FAFSA form must consent annually.

The consent will be required when a student submits a FAFSA, chooses Income-Driven Repayment (IDR) when starting loan repayment, or submits the Total and Permanent Disability discharge (TPD) within the U.S. Department of Veterans Affairs for totally and permanently disabled students.

The consent is necessary not only for the Department of Education to request federal tax information from the IRS but also to use that FTI in the federal student aid application process, as well as do other things such as redisclose that information to certain eligible entities, such as higher education institutions.

If a student, spouse, or parent doesn't provide consent on the FAFSA, the Student Aid Index (SAI) will not be calculated, and the student will not be eligible for any federal aid, CA state aid, or CSU aid.

According to the IRS tax year 2022, these are the thresholds by filing status. If an independent student (and spouse, if married), or a parent of a dependent student, were not required to file a federal income tax return for 2022, then the student will automatically receive a Student Aid Index (SAI) equal to –1500 (negative 1,500).

They still need to provide consent when submitting the FAFSA, so the IRS can confirm to Federal Student Aid (FSA) the student, parents, and spouse didn't file taxes.

No. Starting FAFSA 2024-25, the DRT will no longer exist. After the student, spouse, and/or parent provides consent to the Direct Data Exchange (FADDX), the Federal Tax Information (FTI) will be linked to the application contributor. Federal Student Aid (FSA) will now directly transfer Federal Tax Information (FTI) from the IRS into the FAFSA form as long as the user has provided FSA with the consent to do so.

All users identified as required contributors on a particular FAFSA form will be prompted to provide consent for the IRS to use their Federal Tax Information (FTI). This consent is required to retrieve FTI from the IRS to calculate the student's aid eligibility. If any party to the FAFSA form does not provide consent, submission of the form will still be allowed. However, a Student Aid Index (SAI), which replaces the Expected Family Contribution (EFC), will not be calculated, and the student will not be eligible for any federal student aid, CA state aid, or CSU aid.

Starting with the Simplified FAFSA, students will determine which parent to report based on which one provides the most financial support. It is ok if the parent or parents reported do not claim the student on their taxes. The reported parents will provide consent to transfer their taxes data even if they do not claim the student on their taxes.

Yes. If the parent providing more financial support is remarried, the stepparent's tax information is required.

Our financial aid staff can offer to talk directly with the parent or stepparent to explain why that information is needed and answer any questions, which sometimes puts them at ease about how their sensitive info will be used. However, we cannot provide tax advice.

Independent students or parents are the best sources for this estimate; they can also consult their accountant or other financial professional if they have access to one to estimate the amounts to report.

Being self-employed does end up showing business income on tax returns. But it depends on the type of work whether or not they will have to report any assets associated with their business.

Yes. Starting with the 2024-25 FAFSA, when the student, spouse, parent, and/or stepparent provide consent, the IRS's Federal Tax Information (FTI) will include the information from an amended tax return.

After you provide consent on the FAFSA, if the IRS cannot transfer your Federal Tax Information (FTI) to your FAFSA application, the application will allow you to self-report it. Self-reporting one's tax information on the FAFSA does not override the requirement for each required contributor to provide consent on the FAFSA form.

So two items are required:

- Each contributor needs to provide consent, and

- Each contributor needs to provide their income or tax information, either directly from the IRS or self-reported manually on the FAFSA form

Any individual who is a contributor to the FAFSA application must provide consent. This includes parents, and independent students, regardless of their tax filing status. Generally, the parents of independent students are not contributors and would, therefore, not need to provide consent.

Starting with the 2024-25 FAFSA, there will be only two options for filing a FAFSA form:

- Electronically, through studentaid.gov,

- The option to file on paper which will also be available.

There is no option to print a signature page any longer. For this reason, financial aid administrators will not be able to submit complete FAFSA forms because of the consent provision that all contributors must provide and sign.

Students and parents will be required to have an FSA ID to complete the FAFSA application online. If they choose to mail a paper FAFSA, both will need to provide consent on the paper FAFSA, and both will need to provide wet signatures and mail the application to the Department of Education address on the paper application. This method is not recommended due to complexity and increased processing time.

Fraud or identity theft are the most likely reasons for the IRS not providing tax information to the applicant or the contributor. If the contributor has been flagged by the IRS, possibly due to identity theft or a breach of some sort to their information, then the IRS response code will be IRS enabled to provide information.

Beginning with the 2024-2025 FAFSA, there will no longer be a separate signature page, and there won't be a consent signature option on paper. There are two alternative options for contributors to provide consent who do not want to or refuse to create an FSA ID. One option is to submit a paper FAFSA form completed by all contributors and mailed to the Federal Student Aid. This method is not recommended due to complexity and increased processing time.

Frequently Asked Questions - Student Aid Index (SAI) and Pell Grant

SAI, or Student Aid Index, is replacing the term Expected Family Contribution, known as EFC. The SAI brings a change in the methodology used to determine aid.

- The SAI is a number used to determine eligibility for need-based aid. It is calculated using information the student (and contributors, if required) provides on the FAFSA form.

- The SAI will replace the Expected Family Contribution (EFC) starting in the 2024–25 award year.

- A student’s SAI can be a negative number down to –1500 (negative 1,500).

Important: Your aid eligibility is based on the following formula:

Cost of Attendance (COA) – Student Aid Index (SAI) – Other Financial Assistance (OFA) = Need.

The Student Aid Index (SAI) represents a change in the methodology used to determine aid:

- Child support received will now count as an asset instead of income.

- Family farms and small businesses will now count as assets.

- The number of family members in college is no longer considered in the needs analysis formula, but it is still a required question on the FAFSA® form.

Maximum Pell Grant - Students may qualify for a maximum Pell Grant based on family size, adjusted gross income, poverty guidelines, and tax filing status. Students qualifying for a maximum Pell Grant will have a Student Aid Index (SAI) between –1500 and 0.

Student Aid Index (SAI) - Students who don’t qualify for a maximum Pell Grant may still be eligible if their calculated SAI is less than the maximum Pell Grant award for the award year. The student’s Pell Grant award will be equal to the maximum Pell Grant for the award year minus their SAI.

Minimum Pell Grant - Students whose SAI is greater than the maximum Pell Grant award for the award year may still be eligible for a Pell Grant based on family size, adjusted gross income, and poverty guidelines.

According to the IRS tax year 2022, these are the thresholds by filing status. If parents of a dependent student or an independent student (and spouse, if married) were not required to file a federal income tax return for 2022, the student will automatically receive a Student Aid Index (SAI) equal to –1500.

For the 2024–25 aid year, some financial information previously considered income will be considered as assets. Also, some information not requested previously, like the family’s small business, will no longer be excluded from asset reporting.

Students with a negative or 0 SAI will be eligible for the maximum Pell Grant. The difference is that the negative -1500 SAI indicates the student has a higher need than the student with 0 SAI, being eligible for other grants, if available, like Federal Supplemental Educational Opportunity Grant (FSEOG) or institutional need-based grants.

It will be based on the family size that the family entered, if different from the taxes. Students may have to provide additional information to verify the household size if selected for verification.

|

Negative SAI |

Pell Grant - Max/Min Determined by |

|

|

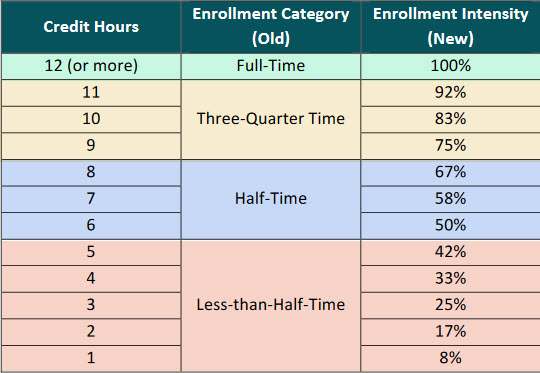

Beginning with the 2024-2025 aid year, the Pell grant will no longer be based on enrollment status. Instead Pell Grant disbursement amounts will now be calculated using Enrollment Intensity - which is a percentage value based on the number of credits a student is enrolled for during a term.

For federal student aid purposes, full-time enrollment is 12 credit hours. Below is a chart of enrollment intensity relative to full-time enrollment. Note that enrollment intensity cannot exceed 100% for purposes of Pell Grant proration.